Exclusive: Trump’s crypto project security advisor reveals major reason for 272 wallet blacklistings

World Liberty Financial, the Trump-family linked crypto project, has drawn backlash after blacklisting 272 wallet addresses in the days following its token launch.

In a conversation with TheStreet Roundtable, WLFI’s pseudonymous security advisor, Ogle, outlined why some holders suddenly found their tokens frozen and why, in his view, tougher screening comes with the territory.

Ogle is a cybersecurity expert who has helped recover over $400 million from major hacks, including Euler, Curve/Alchemix, and KyberSwap. He’s the co-founder of Glue, a blockchain ecosystem, and a serial entrepreneur who has built multiple multi-million-dollar tech companies.

“There are certain people who use wallets that are sending a bunch of money through Tornado Cash, or interacting with sanctioned [entities],” Ogle told TheStreet Roundtable. “You can’t expect a project associated with the President of the United States of America is going to be doing that.”

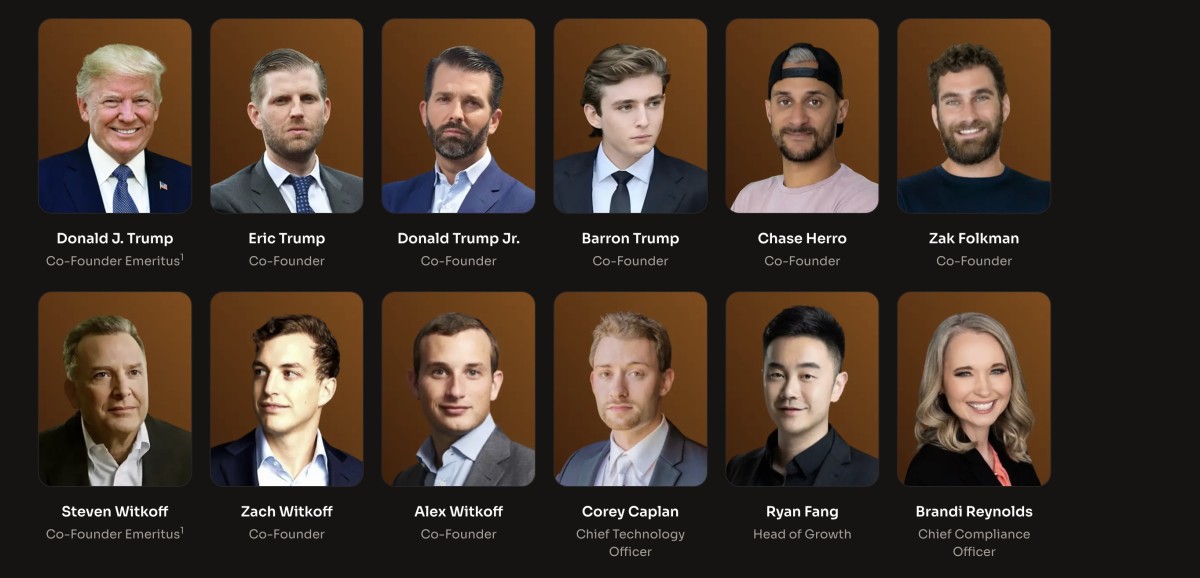

Notably, the World Liberty Financial website lists President Donald J. Trump and real estate mogul Steven Witkoff as ‘Co-Founders Emeritus’, a title signaling they are founders but not involved in daily operations. Active co-founders include Eric Trump, Donald Trump Jr., and Barron Trump, who are prominently featured as part of the leadership team.

Donald Trump and Eric Trump featured as part of the World Liberty Financial founding team. (Source: World Liberty Financial)

Sun claims his address was blacklisted

The news came into public scrutiny when on Friday, Justin Sun claimed his WLFI allocation was frozen after a $9 million transfer was flagged on-chain, fueling a broader fight over compliance tools, decentralization, and what “blacklisting” should mean in a token economy.

Notably, in 2024, Sun revived interest in World Liberty Financial with a $30 million investment before the election, a stake he later increased to $75 million.

Sun posted on X calling the freeze “unreasonable,” arguing that tokens should remain “sacred and inviolable.” In a separate post, he said his wallet activity amounted to “generic exchange deposit tests” and “address dispersion,” not selling.

What triggered the freezes

WLFI publicly acknowledged the action in a detailed thread, saying 272 wallets were blacklisted “to prevent harm while we investigate and help impacted users.” The team’s breakdown:

9% (215 wallets) tied to a phishing attack, WLFI says it stepped in preemptively “to stop hackers from draining funds” and is working with rightful owners to secure and move assets.

18% (50 wallets) were reported compromised by owners via support, and were blacklisted at their request.

The remainder were flagged for “malicious or high-risk activity.”

“We do not seek to blacklist anyone,” WLFI wrote.

"We respond when alerted to malicious or high-risk activity that could harm community members. User safety > everything.”

Ogle emphasized he’s not the person pressing the blacklist button nor handling appeals. “I have absolutely nothing to do with this process” but said the rationale is straightforward: AML and sanctions exposure can’t be ignored.

For context, World Liberty Financial calls itself the company bridging the gap between “Web2 and Web3” and “breaking barriers for the unbanked,” on the company’s website.

Ironically, the project is now facing backlash for allegedly engaging in the very practice it was meant to oppose “debanking.” Eric Trump has repeatedly used the term to describe the family’s own exclusion from traditional banking, framing it as the reason they embraced crypto. He has often portrayed digital assets as a way to restore financial autonomy, making the blacklisting of WLFI addresses a striking contradiction in the eyes of many in the crypto community.

“It’s not a bank… In this case, it’s just an investment. You still have access to these tokens if you want them, you can buy them on the open market. No one has restrictions on that. It’s just the private [sale] part… that there are restrictions around,” Ogle responded to comments of at least 273 addresses being blacklisted.

Critics cry foul, and question the tools

Bruno Skvorc, a Polygon developer, claimed his address was labeled “high risk” and alleged that WLFI “stole [his] money.”

“This is the new age mafia,” he wrote on X. “There is no one to complain to, no one to argue with, no one to sue.”

I just got a reply from @worldlibertyfi. TLDR is, they stole my money, and because it's the @POTUS family, I can't do anything about it.

This is the new age mafia. There is no one to complain to, no one to argue with, no one to sue. It just... is. @zachxbt THIS is the scam of… pic.twitter.com/m6NP9VmHfd— Bruno Skvorc (@bitfalls) September 6, 2025

Skvorc later posted the compliance flags he says were cited, an old Tornado Cash interaction (40 ETH), indirect links to sanctioned venues Garantex and Netex24, and a touchpoint with a dashboard later marked as a scam.

On-chain investigator ZachXBT warned that popular compliance screens too often mislabel addresses as “high risk” due to noisy heuristics (e.g., distant “hops,” routine DeFi interactions):